They are often clients or clients who haven’t but paid for the products or services they’ve received. In abstract, sundry collectors symbolize the enterprise’s liabilities, while sundry debtors characterize the business’s property. Moreover, sundry earnings could come with tax implications that must be addressed by the business.

What Is The Distinction Between Sundry Debtors And Sundry Creditors?

- Sundry debtors are customers or purchasers who purchase goods or providers on credit but accomplish that sometimes or for small quantities.

- Ledgers have been bodily books, and each customer or transaction type usually required a dedicated web page.

- At registration, the ship is given a port of selection, which is the port from which the vessel normally operates.

- If a company sells part of its real property holdings, the money earned from those transactions would additionally typically be included in sundry account earnings.

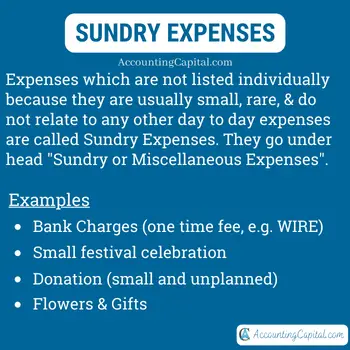

- Other widespread examples embody incidental office supplies, minor restore prices for non-essential gear, occasional postage, or small, unreimbursed travel incidentals.

Sure, though the ring should be of enough value to warrant the costs involved in any sale and the official receiver should not take engagement rings as a matter in fact. In precept an engagement ring constitutes a gift conditional on the wedding or civil partnership happening, so the ring doesn’t pass as property to the recipient till the wedding has taken place. If the ring is of adequate value to understand, it might be possible to effect a sale of the ring to a family member or other third celebration launched by the bankrupt.

Corporation Tax And Income Tax

Begin by establishing a transparent https://www.kelleysbookkeeping.com/ sundry invoice coverage that defines what kinds of transactions are considered sundry and the thresholds for amounts. Integrating sundry invoices into the broader monetary management framework is crucial for sustaining an entire and correct picture of a business’s funds. Manufacturing businesses may report sundry invoices for minor equipment repairs, maintenance services, or small purchases of uncooked supplies outdoors common contracts.

What Happens If The Bankrupt’s Fiancé(e) Purchased The Engagement Ring?

This enhances communication with clients and suppliers and facilitates well timed payments. Sundry revenue ought to be sundry assets recorded underneath a miscellaneous revenue account or similar category in the profit and loss statement. This ensures that the earnings is reported individually from the core enterprise income and can be analyzed independently.

There are several misconceptions about sundry invoices that may result in confusion or improper accounting. Addressing these misconceptions helps enhance understanding and administration of sundry transactions. Fourth, guarantee all sundry invoices embody detailed descriptions and clear fee phrases.